29+ reverse mortgage eligibility

All borrowers on the homes title must be at least 62 years old. There are no monthly principal and interest.

Reverse Mortgage Qualification Eligibility Requirements Home Central Financial

Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home.

. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. In addition the loan may need to be paid back sooner such as if you fail to pay.

Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web Reverse Mortgage Development Program Mutual of Omaha Mortgage is looking for sales professionals with a successful background in networking and marketing to join forces. Find Out In Less Than 2 Minutes If A Reverse Mortgage Is Right For You.

Basically you keep the title to your property and get an advance on your equity in. Web A jumbo reverse mortgage is a supersized reverse mortgage that lets older owners of high-value homes borrow up to 4 million of the equity in their property. To find a reverse mortgage counselor that provides telephone and face-to-face counseling nationwide use the HUD Intermediaries Providing HECM Counseling.

Ad While there are numerous benefits to the product there are some drawbacks. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Most jumbo reverse mortgage.

Web To find a reverse mortgage counselor near you search the HECM Counselor Roster or call 800 569-4287. You should have a sufficient amount of equity built up in your home. Web For government-insured HECMs and for state or local government-sponsored single-purpose loans the minimum age is 62.

All homeowners on title must be aged 62 years or over. Web 1 day agoBasically the main reverse mortgage fees are as follows. Compare a Reverse Mortgage with Traditional Home Equity Loans.

The youngest borrower on title must be at least 62 years old live in the. Ad Looking For Reverse Mortgage For Seniors. Web A reverse mortgage enables you to withdraw a portion of your homes equity to supplement your income or to purchase a home.

The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Web The use of reverse mortgages to hedge investment portfolios is a perversion of the original intent of the HECM Program and a misuse of FHA insurance that puts the FHA.

Web A reverse mortgage can be an expensive way to borrow. Ad Eliminate Monthly Mortgage. Web In a reverse mortgage the lender pays you for equity in your property.

Web Here is how our reverse mortgage calculator works In Step 1 we will ask you to provide your age estimated home value and how much money you owe on your current home. An Overview Of Reverse Mortgage And How It Works. The basic requirements to qualify for a reverse mortgage loan include.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web Supplemental Security Income SSI SSI a federal program for the elderly or disabled requires its participants to have an income beneath the federal poverty level.

The older you are the more funds you can receive from a Home Equity Conversion. Your Reverse Mortgage Advisor can. Check Your Eligibility For A Reverse Mortgage.

Web You need to enable JavaScript to run this app. These fees are paid out at the loans closing and are fixed at a fee rate of between. Web Reverse Mortgage Eligibility.

3 Important Qualifications For A Reverse Mortgage In 2023

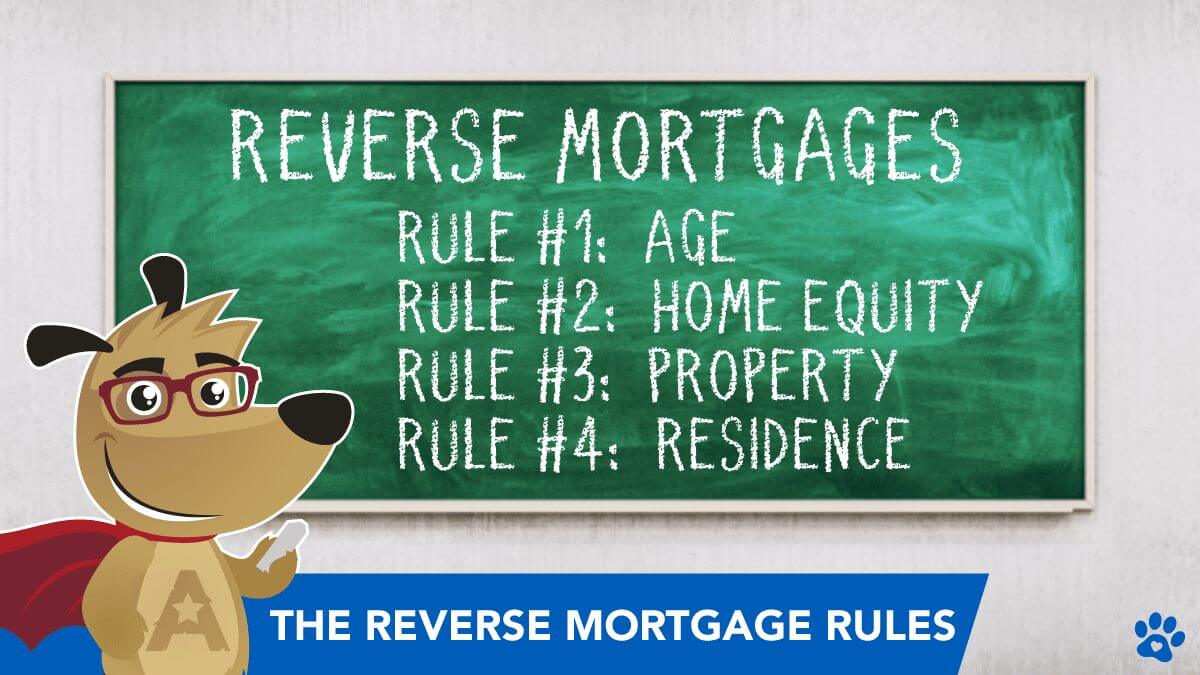

5 Rules That Apply To Reverse Mortgages In 2023

Reverse Mortgage Qualification Eligibility Requirements Home Central Financial

Eligibility Requirements For Reverse Mortgage Rmf

Reverse Mortgage Qualifications Eligibility Goodlife

Reverse Mortgage Eligibility Requirements Find Out If You Qualify

Reverse Mortgage Eligibility Requirements Find Out If You Qualify

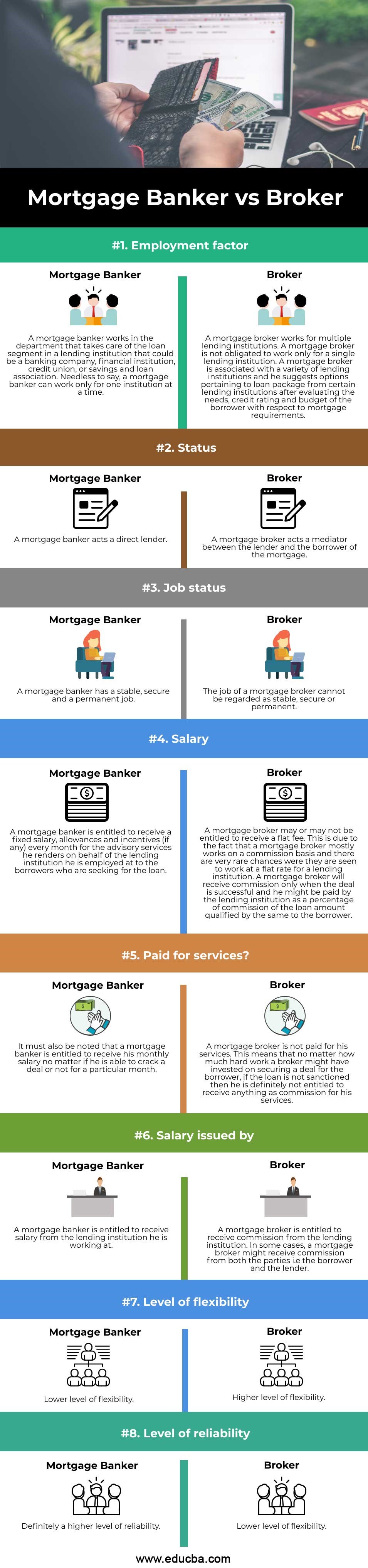

Mortgage Banker Vs Broker Top 8 Difference To Learn With Infographics

What Is Fannie Mae Purpose Eligibility Limits Programs

Eligibility Requirements For Reverse Mortgage Rmf

Eligibility Requirements For Reverse Mortgage Rmf

Reverse Mortgage Requirements What You Need To Know Total Mortgage

:max_bytes(150000):strip_icc()/shutterstock_106623704-5bfc3695c9e77c00519d1585.jpg)

What You Need To Qualify For A Reverse Mortgage

5 Rules That Apply To Reverse Mortgages In 2023

Reverse Mortgage Eligibility Requirements

The Hidden Perks Of Taking A Reverse Mortgage Loan

Eligibility Requirements For A Reverse Mortgage Rr